Recently, Warren Buffett has announced the selling of all of Berkshire Hathaway’s airline stocks. That includes the ‘Big 4’ US airlines that he had a stake in.

____________________Delta Airlines Share Price Updates

Updates on share price will be added periodically

-

DatePriceNews Updates

-

1 Jun$25.21Confidence in recovery of airline industry has already paid off – somewhat. Passenger count continues to grow in US air travel

-

14 May$19.38Delta Airlines announces retiring of B-777 fleet

-

6 May$21.00Shortly after Warren Buffett announces the selling of all of Berkshire Hathaway’s stake in airlines

-

6 Apr$22.32Some calculations updated to reflect the unfolding of COVID-19

-

10 Mar$45.47Initial valuations carried out

-

1 Jan$56.88-

Recently, Warren Buffett has announced the selling of all of Berkshire Hathaway’s airline stocks. That includes the ‘Big 4’ US airlines that he had a stake in. Today, many are already speculating that this was a mistake.

“We’re buying businesses to own for 20 or 30 years. We buy them in whole, we buy them in parts ... and we think the 20- and 30-year outlook is not changed by the coronavirus.”

- Warren Buffet on Coronavirus

"The real question is: Has the 10-year or 20-year outlook for American businesses changed in the last 24 hours or 48 hours?"

So clearly it has for airlines. Or has it?

Let’s take a look at one of the airlines, Delta Airlines:

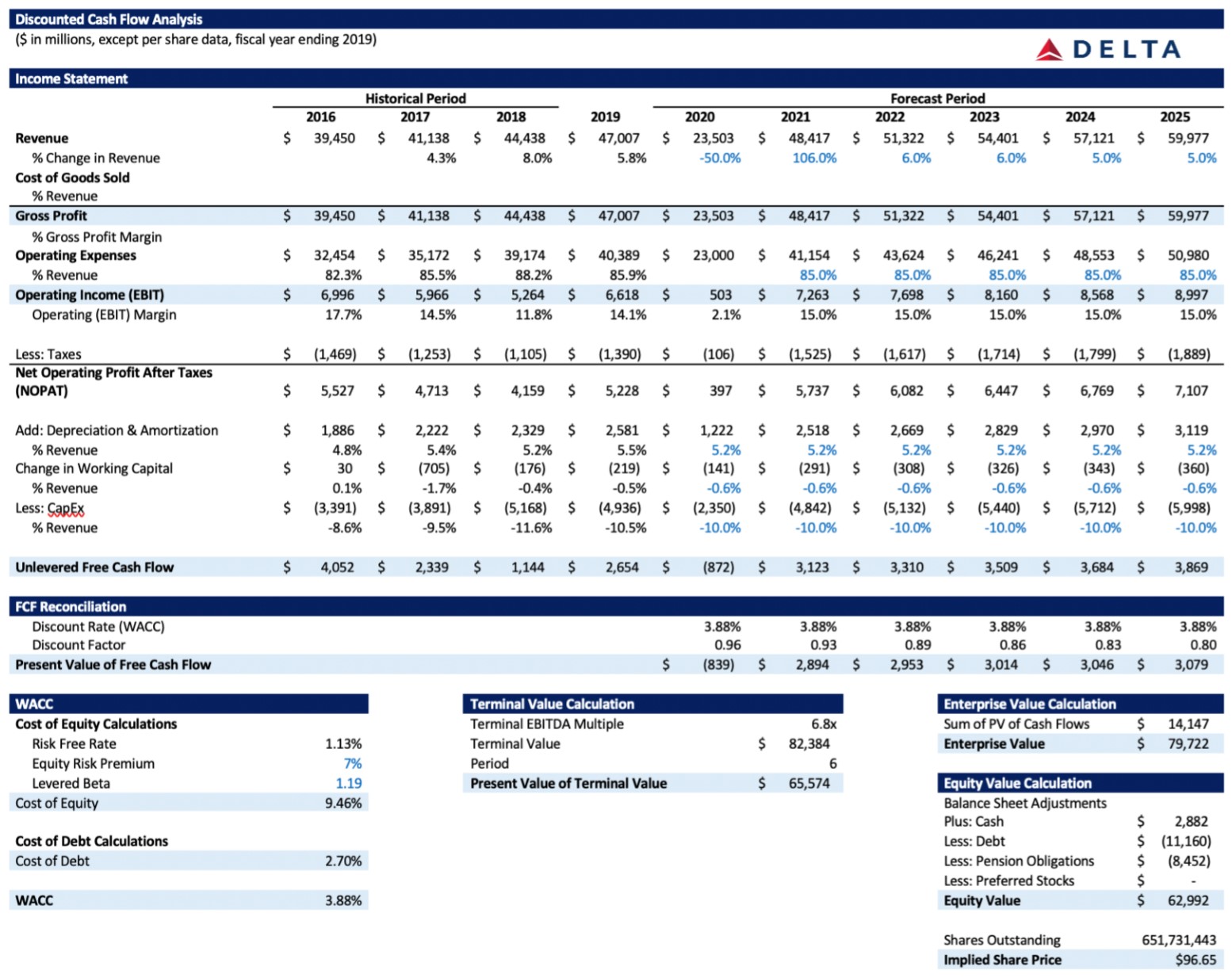

Assumptions made

Revenue

One of the main assumptions made is a quick recovery of the aviation industry as a whole in 2021. (As of March 2020 when some of these calculations were made, COVID-19 has not fully unfolded and it remains to see the full extent of impact it has on the industry and economy.) This is under the premise that air travel is ultimately hugely crucial to many businesses, the general population and economy. While retail takes a large hit that may see some time before it returns to its full capacity, airlines also have the opportunity of a government bailout.

Undeniably, the cash burn will hugely impact the cash reserves of all airlines. Taking a look at the cash assets of the 4 of the major US airlines, United, Delta, American and Southwest, have as of 2019 a relatively sizeable accumulation of cash and cash equivalents, which serve as a rather timely buffer that can prove critical in keeping the airlines afloat for at least a number of months.

EBIT

While operating costs have remained largely consistent, at around 85% of Revenue in trailing years, this would serve as an inaccurate projection for 2020 as the aviation industry continues to incur massive amounts of rental, service, and other overhead costs while in-operational. Simply, EBIT for 2020 was assumed to be near 0, as there have been huge cutbacks on employee salaries and other overheads as well as some fuel savings from the ongoing Russia-Saudi Arabia price war, assumed to offset the losses in overall. (Note: Delta Airlines does not do fuel hedging.)

For simplicity and reducing uncertain variables, all other projections are taken at a percentage of Revenue.

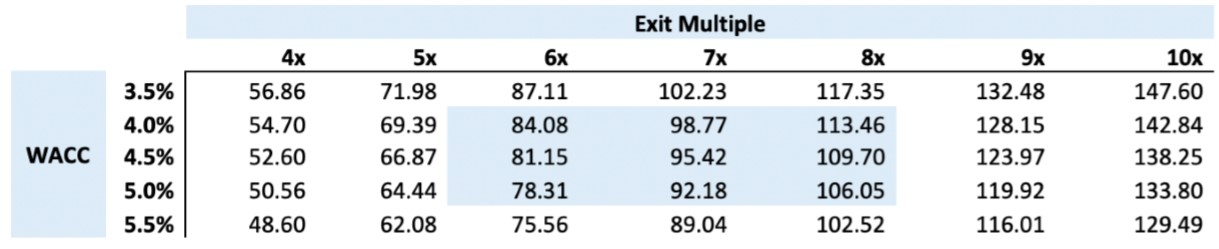

Sensitized WACC and exit multiples.

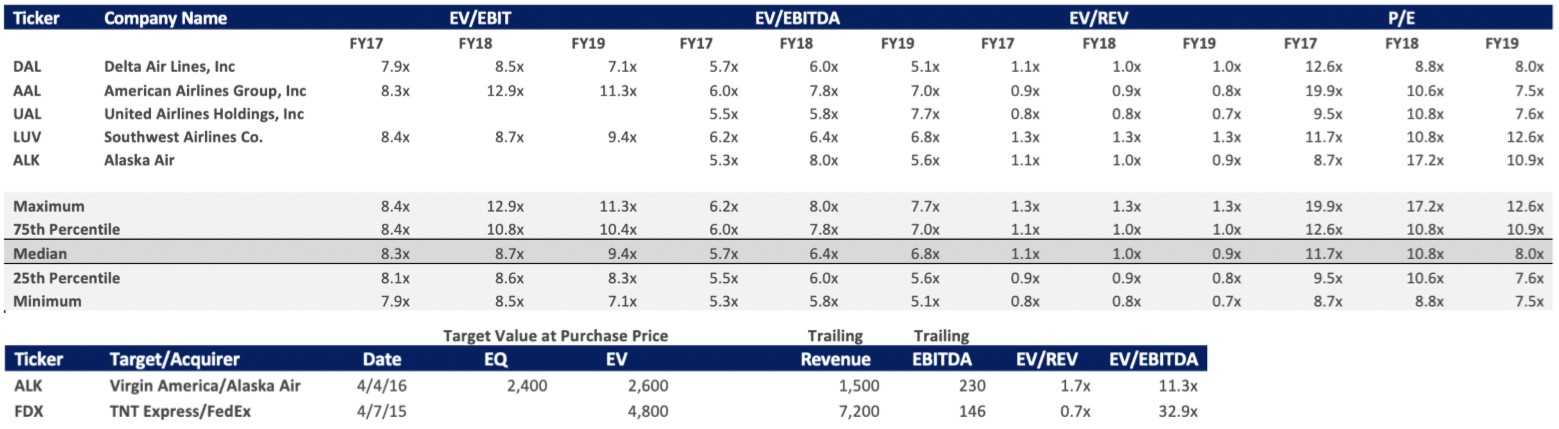

Public Comparables and Precedent Transactions (Large US based carriers of a similar revenue and market capitalization)

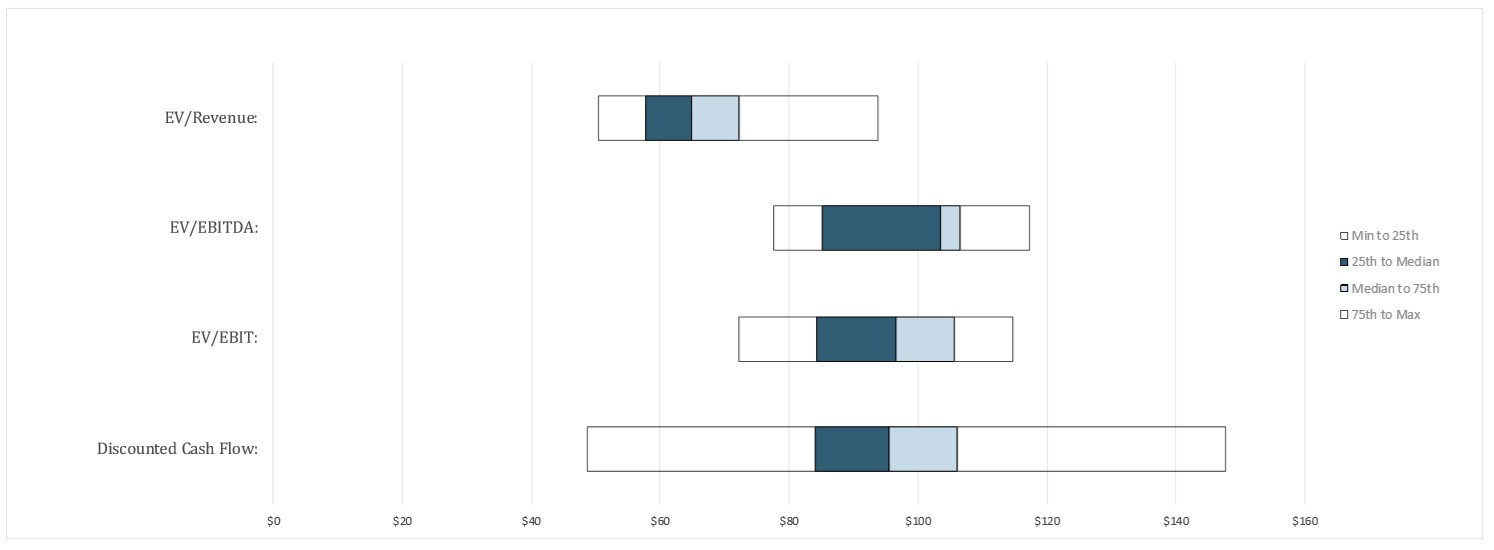

Football Field Analysis

Implied Share Price - $80-90

While the implied share price of around $80-90 will undeniably be an optimistic valuation of Delta Airlines and airlines as a whole, and it remains to be seen the accuracy of the recovery of the industry. Nevertheless, as history serves to remind us that the market often repeats itself, airline stocks have fared extremely well after numerous financial crises in the past, including after the SARS pandemic in 2003, as well as the 2008-09 financial crisis. Warren Buffett’s aversion to risk-taking in airline stocks could well be due to the volatility and frequency of airline mergers and bankruptcies that go against his fundamental investing principles.

Recently, many have regarded the current undervalued stock prices as a good chance to pick up airline shares. Confidence in the quick recovery of airlines, backed by historical trends of the strong recovery of the aviation sector after crises, as well as the opportunity for a government bailout, has led many money managers to speculate if airlines will be hit as hard as other industries have after all.

Whether this crash represents an incredible buying opportunity for airline stock can only be told as the impact of COVID-19 unfolds over the next few months. A section above the post has been dedicated to tracking the share price of Delta Airlines over 2020, edited regularly to analyze the accuracy of my projections.