The China-based platform connects a rapidly growing customer base with medical aesthetic providers in Asia. It has forged a strong community through encouraging user-generated content. What appears to be a blemish on its glowing future is past earnings and the threat of larger competition.

____________________So-Young International (NASDAQ:SY) is trading at $12.40 as of 26 August. We are targeting $24.30.

Now don’t go dismissing this as fantastical numbers just yet.

From a market potential viewpoint, rising incomes amongst the Chinese middle class means an increase in luxury spending. Mobile phone internet user penetration is also forecasted to grow 3% annually. With China’s vast population, that’s 45 million new customers every year! All the factors are converging for a massive surge in China-based online businesses, and So-Young happens to be the market leader of a niche service – online medical aesthetics.

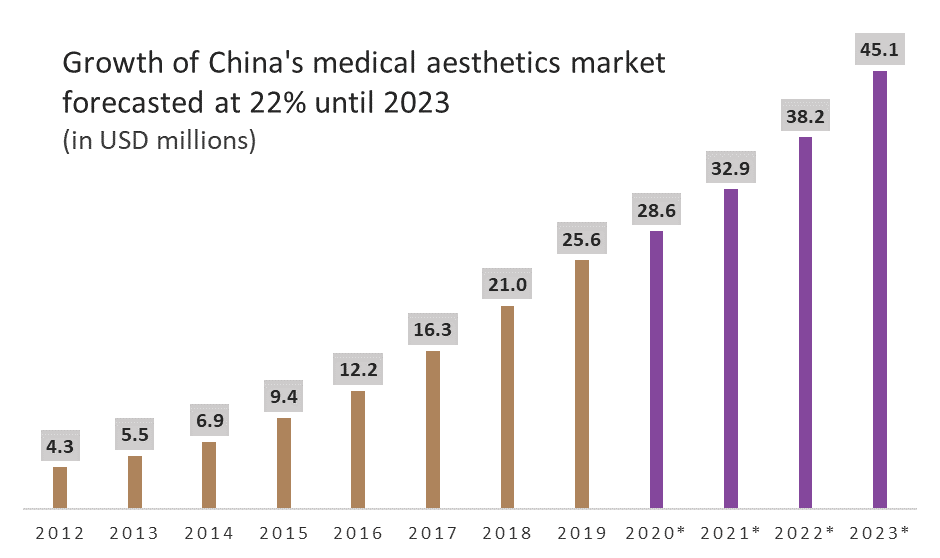

China’s medical aesthetics market to grow 22% annually, reaching USD 45 billion in 2023.

What part can So-Young play?

Currently, medical aesthetic service provides face extremely high acquisition costs per client – USD 600 to 900. In 2018, these providers spent USD 5 billion on customer acquisition alone, the biggest share going to traditional TV and newspaper advertisements.

Looking for cost-effective marketing channels has become a high priority for them. Customer acquisition via specialized platforms like So-Young comprised just 7% of total spending in 2018, but that number is sure to increase when providers reap the benefits of targeted advertising.

So-Young is best positioned because of its strong branding and customer value proposition.

Upon entering the mobile app, users can pick from a multitude of functions. They can compare services, look at licensing information and reserve appointments at the clinic or hospital they prefer. 10% of their bill forms the reservation services revenue for So-Young.

Beauty Diaries, the app’s most popular feature, is what truly differentiates it. Users can read reviews of other clients who have undergone cosmetic surgeries, coming across as more credible in an age where social media influences our decision-making. In 2018, the app accounted for 84% of total daily user time spent on online medical aesthetic service apps, trumping its four other competitors. Beyond reservation services as a revenue channel, the company also allows service providers to pay for advertising on a yearly contract.

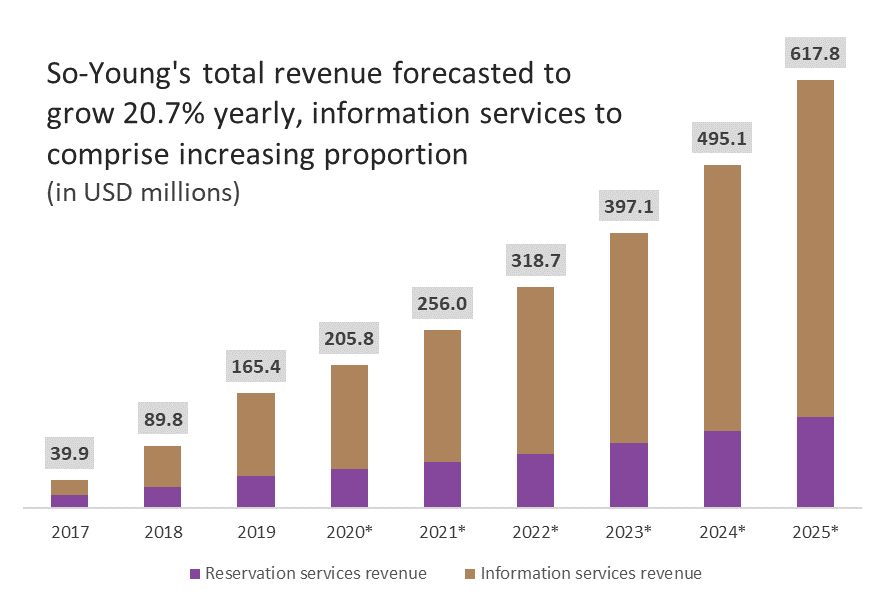

The company has tripled its purchasing user base and revenue from 2016 to 2019.

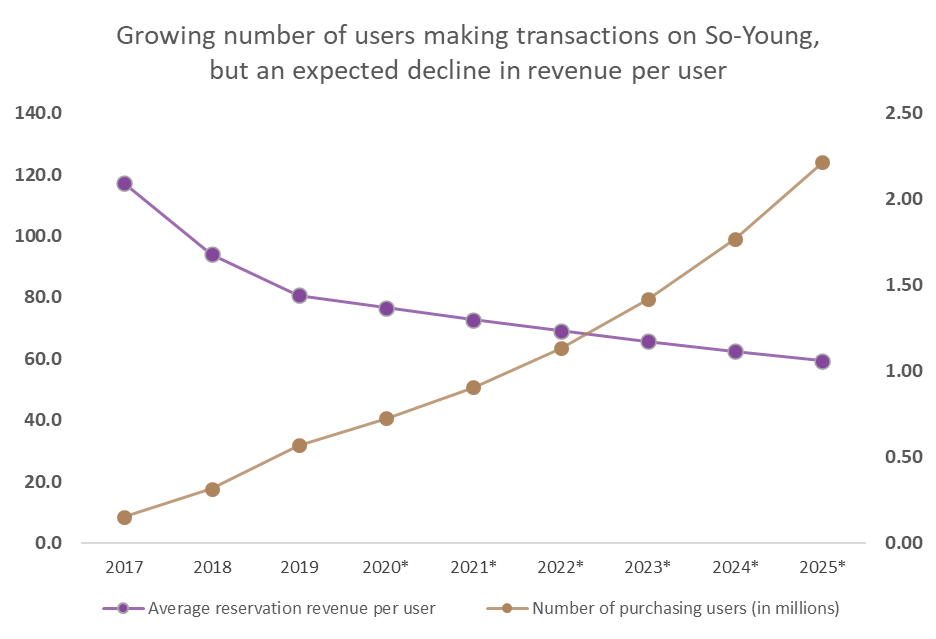

For reservation services revenue, we looked at the proportion of its monthly active users (MAUs) who would make transactions through So-Young and how much the company would collect per user. We expect MAUs to grow at 25% yearly, with just 20% of them making reservations online. One point of weakness is that the average reservation revenue per purchasing user (ARPU) is declining.

Our best guess is inherent competition between providers themselves to discount prices – unfortunately for a platform like So-Young, they become the collateral damage. Even when using a 5% decline in ARPU, we forecast reservation revenue to reach USD 131 million by 2025.

For information services revenue, all the factors are pointing upwards. In 2019, the number of providers subscribed to the advertising service was 3,111 and the company collected USD 119 million in revenue. I was extremely surprised at first, as this meant the average provider was paying USD 38,000 to advertise yearly! However, considering the high acquisition costs they were facing in offline channels of USD 600 – 900 per customer, this seems reasonable for a yearly contract.

A conservative estimate that considers price competition and slowing growth still yielded a revenue CAGR of 20.7% until 2025. We estimate that by 2025, So-Young will bring in total revenues of USD 618 million.

This a very realistic number. A report by consulting firm Frost & Sullivan predicted that the total amount spent on acquisition via online medical aesthetic platforms would reach USD 2 billion by 2023. So-Young’s current share of that pie already surpasses it; in 2018, they recorded USD 89 million out of USD 200 million for all platforms. Even without factoring their likely economies of scale, the company’s future is looking bright.

Plugging these numbers into our DCF model arrived at a target price of $24.30. We also conducted a sensitivity analysis, altering our assumptions for the company’s growth rate. This arrived at a range of $21.40 - $29.70.

A few blemishes remain. The company’s earnings in Q1 2020 disappointed and the outbreak of COVID-19 might be a persistent drag.

Earlier this year, So-Young released its earnings call for Q1 2020. Revenues were USD 25.8 million, an 11% decrease from the same period in 2019. Because of the coronavirus outbreak, many service providers likely curtailed their advertisement spending on the mobile app. Customers also were unable to reserve appointments because of the lockdown restrictions in March.

On COGS and operating expenses, they rose by 18% and 41% respectively. Overall, the company experienced a net loss of USD 5.1 million. This was quite worrisome to investors as the company had earned a profit in Q1 2019. China ended its lockdown faster than the rest of the world. This could potentially hint at a quicker recovery in earnings for Q2 2020. However, if those fail to meet So-Young’s expectations as well, the stock price could be due for another drop instead.