The COVID-19 pandemic is underway - as Americans’ purchasing power takes a hit, discount retailers are due for a comeback.

____________________An American chain of discount variety stores that sells items for $1 or less, you could compare Dollar Tree (NASDAQ:DLTR) to household names like Daiso and Value Dollar in Singapore. These businesses tend to be frequented by a customer base whose only demands are low prices and convenience. You can find a store nearly anywhere with the assurance of unbeatable prices.

While COVID-19 has been a challenge to most retailers, businesses like Dollar Tree are uniquely positioned to take advantage of the falling incomes amongst consumers. Unemployment in the United States has skyrocketed to 10.2%, even worse than levels during the 2008 financial crisis. These families would have to stretch their thinning budgets, and with the end of the pandemic nowhere in sight, this could mean consuming more discounted merchandise for the foreseeable future.

A quick look at the numbers

Since 2016, Dollar Tree’s revenue has been growing at 3.3%. It also acquired its competitor Family Dollar in 2015 which serves a wider range of customers beyond the $1 price point. The company’s average profit margin of 34.8% and price-to-earnings ratio of 29.2x is comparable to other general merchandising businesses.

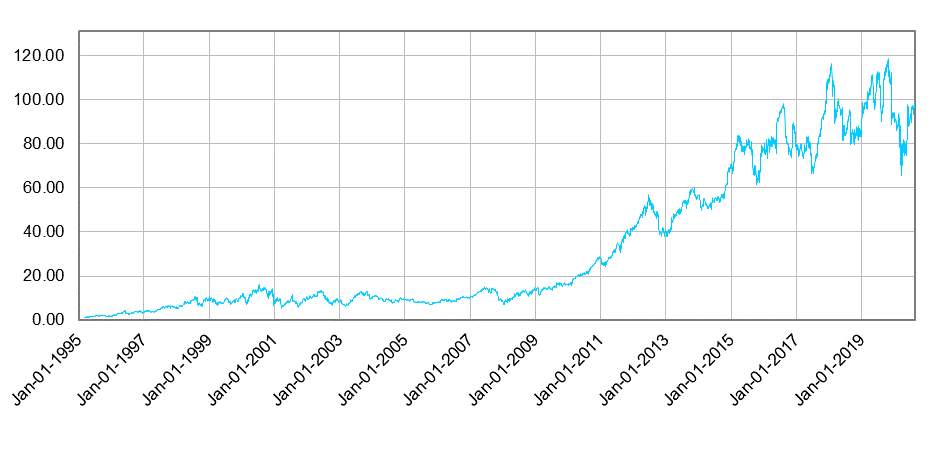

There was nothing particularly impressive about Dollar Tree’s financial ratios. What really stood out to us was how DLTR’s share price reacted after the last major recession, posting double-digit gains from 2009 to 2015. This is an example of a ‘fundamental investing’ decision – looking at the economic environment and industry trends of a company.

We were confident that Dollar Tree would do well amidst the pandemic. However, we still needed to create a valuation range to see where the company stood at its current price. Has the potential already been priced in by hawkeyed investors? Or was there substantial upside to be realized?

To answer these questions, we use a Discounted Cash Flow model. In essence, this estimates the money an investor would receive from an investment, while adjusting for the time value of money. You can read more about its rationale here.

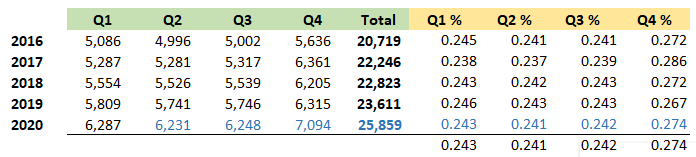

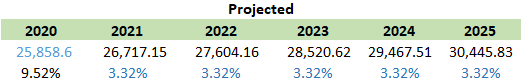

The most important step is projecting revenue. All other expenditures are typically projected as a proportion of revenue, therefore getting accurate estimates here is important. For the retail industry, sales tend to be seasonal. Thus, we felt an appropriate way to go about projecting revenues was by first breaking the past five years’ data into individual quarters.

We then calculated each quarter’s revenue as a percentage of the year’s total revenue and derived an average. Since Dollar Tree released its Q1 2020 earnings already – an 8% jump from last year – we used it to extrapolate the earnings for the rest of the year and arrived at a total revenue of $25.8 billion for 2020. From 2021 to 2025, it was simply a matter of using the compound annual growth rate from 2016 to 2019.

Next, was to project the rest of the components of cash flow. These were all assumed as a proportion of the year’s revenue. For tax, because the company’s effective tax rate can change drastically from year-to-year, we used the long-term corporate tax rate of 21% in the United States. While we were content with the method we used, one contentious assumption would be keeping gross profit margin the same. A more comprehensive look into the company’s cost structure during COVID-19 might have led to a different outcome.

Putting it all together – what’s the upside?

We arrived at a target price of $127, representing 30% upside from its current price. Even when altering our assumptions, the sensitivity table yielded a valuation range from $97 - $164. Considering that DLTR is priced right at the minimum of that range, we went ahead to purchase some shares.

What Wealth Wonka is on the lookout for

Dollar Tree will be announcing its earnings on August 27, where we would see if the market played out as we expected. Some problems that might drag on the share price would be its success relative to its closest competitor – Dollar General (DG). DG’s earnings in Q1 2020 beat analyst expectations by a superior margin compared to DLTR’s performance. This led to DG pulling away with its stock now twice the price of DLTR.

We’re sticking to our underdog, however. Both companies’ have similar revenue and Dollar Tree boasts a slightly better profit margin. DG’s gains are most likely priced in already, and if the upcoming earnings report confirms our expectations, DLTR could be headed all the way up too.