These next two weeks, I am going to share on one of the companies that I believe will experience massive growth as the digital shopping trend flourishes. Our focus is on digging for ‘diamonds in the rough’ – stocks that are well-positioned to make significant gains in 2020.

____________________As the current pandemic continues to plague businesses, one glimmer of hope is that retailers are finally being forced to adopt e-commerce as a solution to their ongoing woes. Across all industries, online sales have dramatically increased. The United States saw a jump of 49% - almost rivalling its annual Black Friday sales, with online groceries and electronics leading the way as customers are forced to stay home.

These next two weeks, I am going to share on one of the companies that I believe will experience massive growth as the digital shopping trend flourishes. This also means we are excluding big names like Amazon and Shopify. While everyone knows they are money-making machines, their share prices have reached all-time highs. Our focus instead is on digging for ‘diamonds in the rough’ – stocks that are well-positioned to make significant gains in 2020.

1. Pinterest (NYSE:PINS)

PINS is currently priced at $16.61

Our first pick is the popular image sharing and social media service Pinterest. Before I started researching for this article, I must admit I had no idea the company was even publicly traded. For the longest time, my impression was that Pinterest simply served a niche group of consumers who loved visually exciting DIY projects.

So it was a surprise to discover that in April 2019, the company went public at $19 a share. It was even more amazing when I looked at the company’s monthly active user base growth. It has 87 million active US users – more than 25% of the population – while its international user base is growing over 30% year-on-year.

What has suppressed Pinterest is its earnings. Since 2017, operating income has become even more negative although gross profit has increased by 181% and gross margin remaining around 68% of revenue. Investors would want to see some sign of positive earnings before this share price appreciates. Luckily for us, this usually signals an excellent buying opportunity if we are right.

I delved further into Pinterest’s income statement. The reason operating income has fallen is because of the company’s aggressive focus on acquiring new customers and research and development, amounting to $2.14 bn in expenses. In fact, the company has promised to “reinvest positive surplus earnings into R&D and sales”. This is a common predicament amongst most growing companies in the consumer tech industry – Airbnb and Uber continue to post large quarterly losses by prioritizing customer acquisition.

The problem with Pinterest is its monetization strategy after growing its international customer base. Its monthly revenue per US user is $2.66 compared to $0.13 for the rest of the world. And because expenses will only continue to grow with customer acquisition, its current monetization strategy does not look scalable for the long-term. With all these in mind, I decided to construct a DCF model to project a target price within the next five years. As a growth stock, using negative earnings to estimate free cash flows is risky so I would list the several assumptions I used.

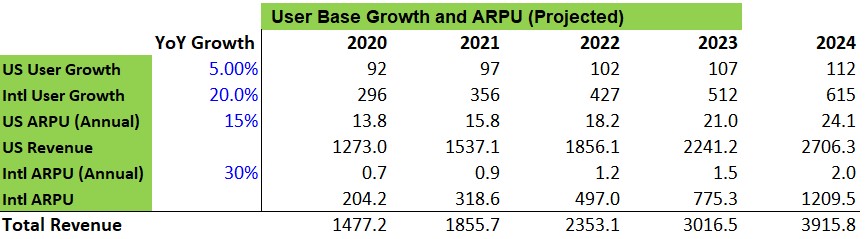

Step 1: Projecting revenue growth through user base growth

I projected that Pinterest’s US user base would grow 5% YoY, and the international user base grow 20% YoY. Both these estimates are conservative compared to current trajectories, but I believe that the US market may be saturated and the competition for digital advertising will only heat up in the next five years, limiting international growth. I predicted that Average Revenue Per User (ARPU) would grow for US users at 15% annually while International ARPU grows by 30%. These estimates may sound high, but they follow a similar pattern to Facebook and Snapchat’s advertising revenues in the past. There is much more scope for revenue growth if Pinterest intensifies marketing efforts at monetizing its international users’ activity – this will dictate how competitive they are.

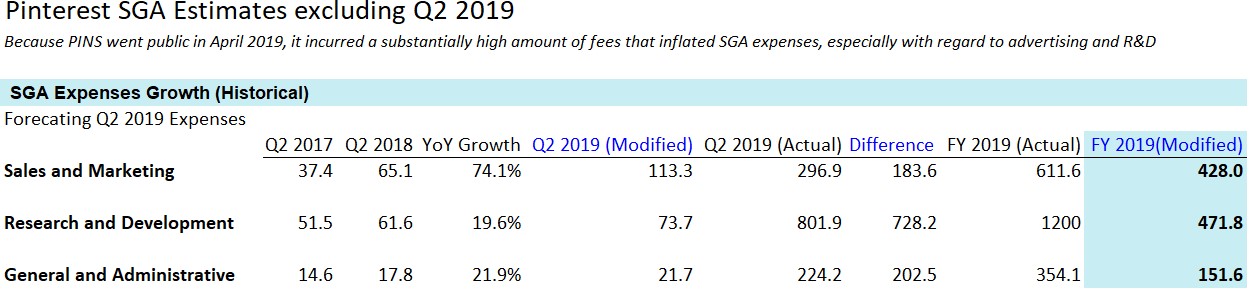

Step 2: Projecting operating expenses, taking into account Q2 2019 pre-IPO expenditure

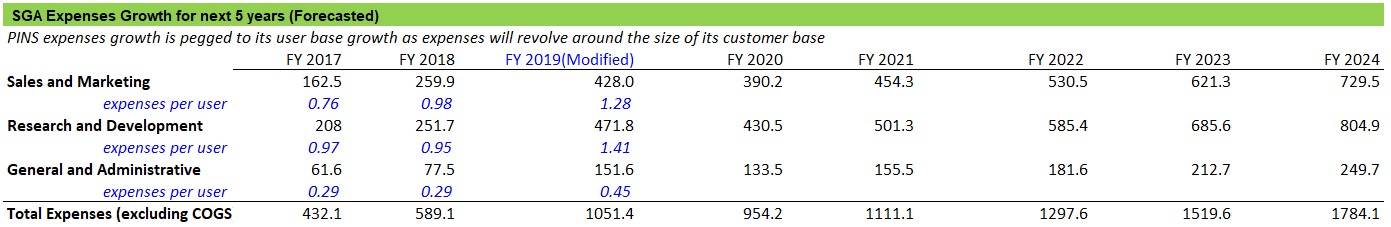

One reason for Pinterest’s abnormally low earnings recorded in 2019 was the expenditure in preparing for its April 2019 IPO. To assist my EBIT projections for the next five years, I recalculated what the average expenses would cost per user if Q2 2019’s operating expenses was modified to follow historical trajectories.

This was used to forecast the next five years’ operating expenses and produce EBIT projections.

Step 3: Finding the discount rate for Pinterest

After free cash flow until 2024 has been calculated, this needs to be discounted to the present. For my calculations, I compared Pinterest to four similar competitors: Facebook, Snapchat, Twitter and Amazon. Like all of them, Pinterest is largely financed by equity with a low risk D/E ratio of 0.08. I arrived at a Discount Rate of 4.92%.

Step 4: Finally, my target upside for PINS

With my DCF model, I projected a price of $30.93 representing an 86% upside from the current price of $16.61. A conservative estimate that used a smaller terminal value gave a result of $23.44, still a respectable 41% upside.

But beyond all these indicators, another reason I think Pinterest is on its way up is that it has occupied a very niche area of advertising. In the United States, it has high levels of engagement with women and half of all millennials aged 18 – 34. For advertisers, access to this attractive group of demographics who spend frequently online is a boon. Because Pinterest connects people with content related to their interests (everyone has a unique dashboard!), it results in a better click-through rate on advertisements.

My final thoughts

The most challenging aspect of this week’s model was finding the financial data for Pinterest and creating projections based off the past three years’ negative earnings. Next week, I will be trying a new valuation method: comparables; stay tuned for “2020 Sleeper Stocks”!