This week, my goal was to dissect Singapore’s blue-chip stock benchmark Straits Times Index (STI) and pick out companies that I expect to emerge stronger after this pandemic.

____________________Today is Polling Day in Singapore. Over 3 million Singaporeans will flock to polling booths across my country, casting their vote for their preferred political party. It has been a pleasant surprise surfing Instagram and Facebook the past two weeks. People from all generations have been sharing about local politics, and actively participating in walkabouts and campaigning. Perhaps this renewed vigour stems from the pandemic opening our eyes to problems in society. Whatever the case, it was immensely gratifying to see individuals want to take charge of their lives.

Anyway, this article isn’t a political piece. What the election saga has instilled in me, however, was a newfound sense of patriotism. I try analyzing foreign companies on the US Stock Exchange, even research the economic policies of Vietnam, but too often neglect my own home. This week, my goal was to dissect Singapore’s blue-chip stock benchmark Straits Times Index (STI) and pick out companies that I expect to emerge stronger after this pandemic. The Strait Times Index is a market capitalization weighted index that tracks the 30 largest companies on the Singaporean stock exchange.

1. CapitaLand (SGX: C31)

The company I chose was CapitaLand. One of Asia’s largest diversified real estate groups, it owns many of Singapore’s shopping malls and has expanded its presence internationally as far as Germany. The company’s share price has fallen 21% YTD. Much of this can be attributed to the restrictions set in place during Q2 2020. Malls were closed and many tenants could not renew their lease.

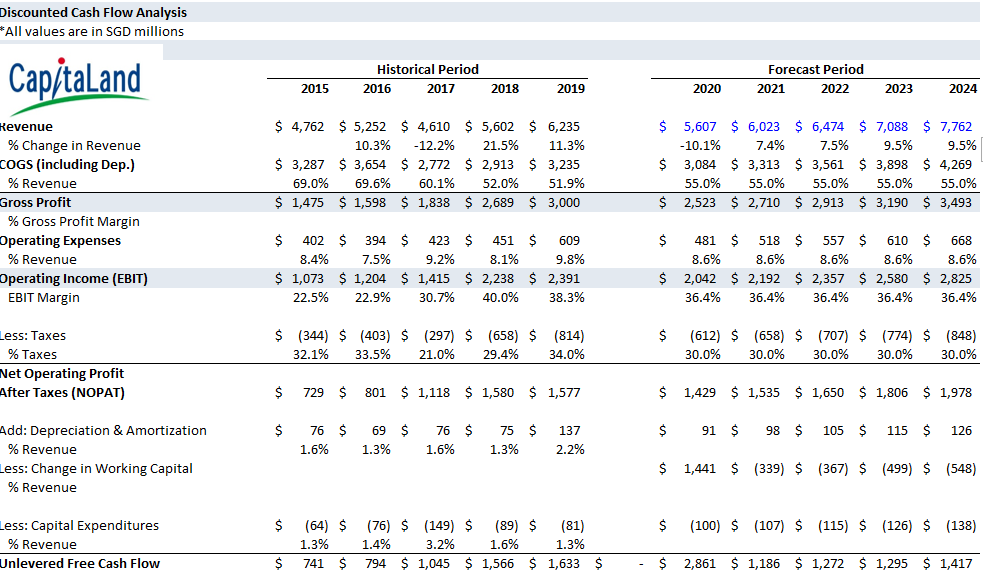

I ran their financials through our DCF model and arrived at a target price of $3.48. Now this doesn’t seem like much of an upside, but there are some discrepancies in my DCF model to address. The free cash flows calculated do not account for gains in revaluation of real estate property which is a huge source of non-operating income for CapitaLand. Admittedly, I did not know how to project these ahead, as the property market can be volatile and I have yet to learn about real estate pricing formulas. Something worth exploring in the next few articles.

A projection of CapitaLand’s free cash flow estimates

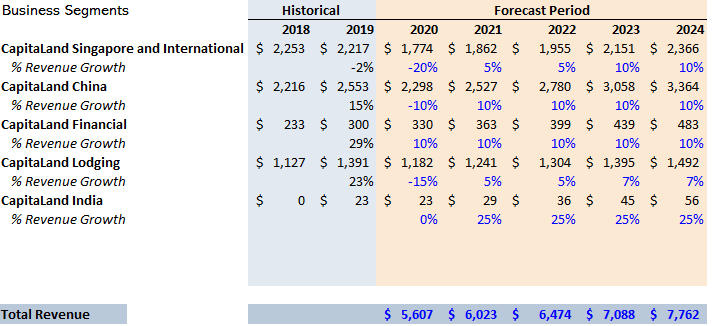

Breakdown of projected revenue by business segments

Therefore, I had to make assumptions about the revenue growth rates based on my thoughts and footnotes from the financial statements. For instance, CapitaLand Singapore and International was projected to have the sharpest drop in revenue in 2020. Singapore imposed stringent measures during the circuit-breaker period and Q2 2020 earnings results would likely give us a better glimpse of it. Conversely, I expected the Chinese business arm to recover and grow at a faster rate especially as the government opened up the economy sooner and there is far more space to expand in real estate development.

Doing this DCF model made me realize a few things. First off, it faces inadequacy when dealing with unexpected changes in the business environment. Often, the model is far more precise when projecting future cash flows based on a series of steady cash flows for the past five years. How much revenue should fall in 2020 cannot be properly predicted and I have no idea how quickly the economy will recover either. Will property prices immediately increase, and will developers want to undertake massive projects as early as January 2021? Another challenging aspect for me was analyzing CapitaLand Financial. The fund management arm of the group’s seven REITs (Real Estate Investment Trust) – I wasn’t entirely sure about how to gauge the value of a REIT and thus, the revenue of this business segment. Next week, that would be my article’s goal: investigating the fundamentals of a REIT.

In conclusion. I think I learnt more about what I didn’t know then what I did know this week. I do feel positive about CapitaLand’s share price rising, but the target upside might not be worth the time waiting. What I do know is that I’m pretty proud a Singaporean company has a market cap of $15 billion and continues to make its name known across the world.