In the second part of my 2020 Sleeper Stocks series, I talk about Fiserv (NYSE:FISV), which provides payment processing software and technology, and evaluating the company in terms of comparables.

____________________At the time this article was written, FISV was trading at $103.93

Our subject of this week is Fiserv (NYSE:FISV), which provides payment processing software and technology. As digital transformation becomes more rampant, companies will need to rely on third parties specialized in conducting such transactions to help them match their customers’ expectations for security and speed.

You might be wondering, how did I come across this company? Its name is unknown in Asia, with e-commerce here still dominated by the likes of PayPal, and occasionally Stripe. But Fiserv also happens to own the naming rights to my favourite basketball team’s arena – the Milwaukee Bucks! So that induced me to begin an analysis of some of the larger payment processing platforms online. Eventually, it turned out the company demonstrated one of the highest potentials for growth.

Tremendous upward momentum of more than 20% YoY prior to 2020

Since 2015, the company’s stock price has been climbing rapidly, at least 20% each year. Its price peaked earlier this February at $119 before plunging to $90. The reasons were largely valid: the stock had been overbought for years now and the company only posted earnings of $1.5 billion in 2019, representing a P/E ratio of more than 50. All this sounds like bad news… so what’s the catch?

In July 2019, Fiserv completed a massive acquisition for First Data Corporation to complement its existing products and services. Revenue would increase by 95% but more importantly, Fiserv’s ability to innovate and meet a wider range of its clients’ needs also grew. This presented a problem for me when doing my DCF model as well. Projecting cash flows would not be as easy considering how vastly different the numbers were from 2018 to 2019.

I decided to adopt a “weighted average” method instead – assigning a 0.575 and 0.425 weighting to Fiserv and First Data respectively based on their equity value prior to acquisition. Then I projected average growth rates of revenue and expenses based on 2015 – 2018 data for both companies and applied my weighting to get average rates. These rates were projected using 2019 post-acquisition financials as a starting point. Eventually, I reached a target upside of 15% and a forecasted share price of $119.

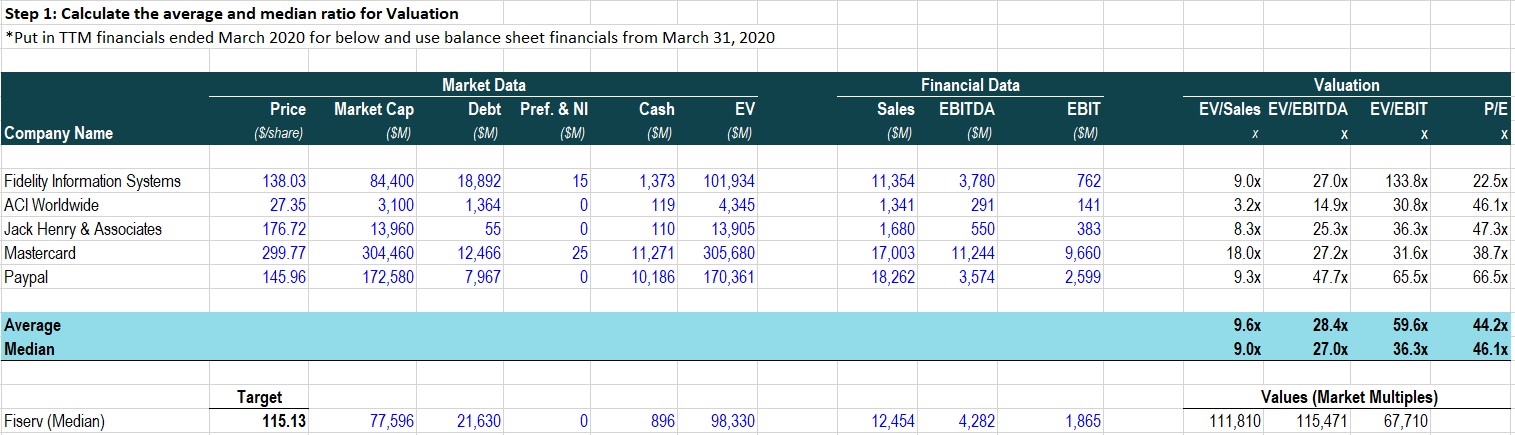

Applying comparables ratios – an alternative method of valuation

There is a reason I skimmed through my DCF findings this week though. By now, you can simply observe my methodology based on the spreadsheets we upload on Wealth Wonka. This week, my focus is on the ‘comparables’ method.

This is an ‘easier to perform’ method then the DCF model because the reasoning behind is simple: calculate the median industry ratios for financial technology companies and apply it to FISV’s numbers. The complication comes in when choosing your competitors. For this week’s article, I chose a mix of high and mid-size companies, all with a focus on operating in the US. As I gain more experience with this valuation method, I will delve further into choosing the right companies.

This time around, I arrived at a target price of $115.13. This was suppressed by Fiserv’s EBIT (TTM) margin that was negatively impacted in Q2 2019. The company incurred heavy expenses incurred during its acquisition of First Data that reduced income, and prior to 2019, had EBIT margins of 27%. If we use the same forecasted EBIT margins of 23.1% as in our DCF model, we arrive at a target price of $133.

Comparison of liquidity, leverage and profitability ratios

I also did a comparison of commonly used financial ratios to see how healthy Fiserv was in relation to its competitors. As it stands, the company’s current ratio and profit margin is below that of the larger Mastercard and PayPal but better than Fidelity – its closest competitor by market capitalization. One thing that does worry me is Fiserv’s ability to meet its short-term obligations. It only carries $896 million in cash and cash equivalents, compared to $12 billion in liabilities. The cash ratio gives investors an idea of whether a company can readily pay off small bills without borrowing more or relying solely on sales, but too high a cash ratio also implies that the money is not being reinvested into the company’s growth.

To gain a better idea of how Fiserv manages its current obligations, we must investigate its financial statements. According to its 2019 annual report, Fiserv needed to amend conditions on its ‘revolving credit facility’ to include the following: raising the maximum leverage of consolidated indebtedness to TTM EBITDA to four times and increasing flexibility to enter into receivables financing arrangements in the future. To me, this is slightly worrying that Fiserv plans to support its activities by drawing down on more debt. For now though, Fiserv’s operating cash flow has been growing at a faster pace than short-term debt.

In conclusion, I think FISV is a cautious buy, but the scalability of its operations positions it well for the upcoming wave of e-commerce. It was great that approaching the valuation from a comparables method gave me a target price less than 5% away from that of my DCF model. Next week, I will focus on how to choose the right competitors for your comparables valuation.