The price of Disney has recently plunged to yearly lows, and we provide our thoughts on whether this is a rare buying opportunity or a falling knife that should be avoided.

____________________Earlier this week, I was reminiscing about the Marvel movies of 2019. The non-stop action and wonderfully crafted fantasy worlds offered a stark contrast to my summer currently spent at home. In fact, before the coronavirus epidemic, ‘Black Widow’ was slated for screening somewhere around May – which I was eagerly anticipating.

Alas, theatres have closed, and moviegoers are flocking to online streaming services like Netflix, Hulu and of course Disney+. I presumed that with the growth in subscribers, these “stay-at-home” stocks would probably be surging. Netflix has indeed reached an all-time high of $415. But for Disney (who also have a majority stake in Hulu), the picture is far from rosy. While Disney+ boasts an impressive subscriber count, other drivers of the company’s revenue are in dire straits. Its theme parks, movie studios have largely ceased operations due to lockdown restrictions across the globe. And its price has contrastingly plunged to a 12-month low of $105.

Thus, the subject of this week’s article: is it time to load up on this entertainment powerhouse? For the first time, I would include technical concepts I learnt over the week, the DCF Valuation model.

A booming subscriber base, but when will profits trickle in

Another aspect to consider for Disney+ is its projected profits for the next 5 years. Although its user base has shot to 28 million subscribers, a lot of the initial 10 million subscriptions were garnered through promotions that have lowered average monthly revenue per user (ARPU). 50% of those initial subscribers enjoyed a three-year discounted rate while about 20% got Disney+ for free through a Verizon promotion. This has pushed down ARPU to $5.56 - a number significantly lower than Netflix’s $10.79. So while Disney+ may be able to compete on attractive pricing, it will require substantial subscriber growth to generate similar revenue.

What does stand out is subscriber growth in other areas of Disney’s ‘direct-to-consumer and international’ segment. Hulu, which has been around for 12 years, saw a YoY growth of 33% for Q1 FY20 while ESPN+ more than quadrupled in paid subscriber count. The company has clearly succeeded with its marketing efforts, revitalizing some of Netflix’s biggest competitors; but expenses will soon kick in when streaming services begin to fight over fan-favourite shows. When Netflix acquired the rights to “Friends” in 2015, it paid $100 million – four years later, HBO paid $500 million.

Higher debt now, but reduced recurring expenses

This has been partially mitigated by Disney’s approach to acquire companies from the get-go, it paid $71 billion for 21st Century Fox which would pave the way for “The Simpsons” and other titles. At the same time, it can create original titles from its massive Marvel and Pixar universes without shelling out enormous licensing fees. So while the company’s debt-to-equity ratio has risen from 0.81 to 1.06, and goodwill increased by 2.5x, the debt incurred to purchased Fox at such a hefty price should not be too worrying if it reduces the necessity of bidding wars in the future.

And finally, the results of my DCF model

For those of you unfamiliar with this term, the Discounted Cash Flow Model is a common valuation technique used for investors to estimate the true market value of a company and gauge how much upside buying the stock presently would have.

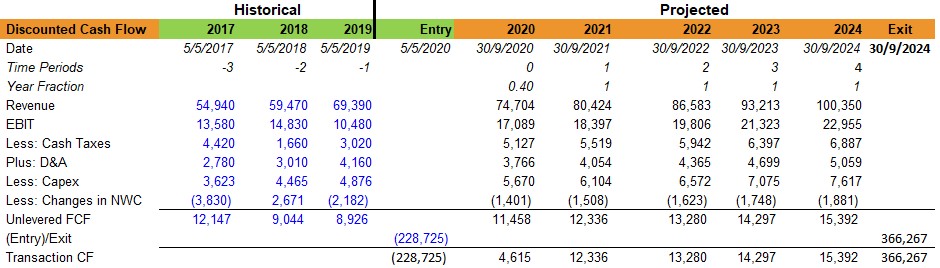

The first step is to project the company’s cash flows over the next five years. This involved projecting revenue growth using historical averages from 2015 – 2019, removing any cash expenditures and adding back depreciation and amortization.

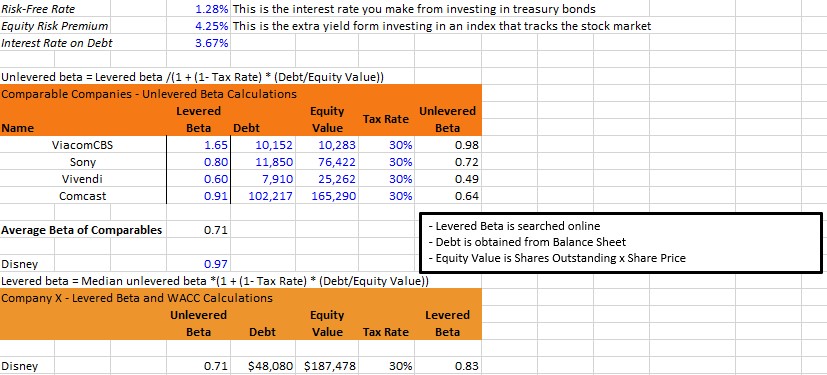

Then, a discount rate needs to be calculated. Essentially, we need to account for the time value of money. If I invest $100 into DIS stock today, I am foregoing interest that I could have collected if I invested it elsewhere. Part of calculating this discount rate involves ‘beta’, i.e. how volatile DIS stock is compared to other companies in a similar industry. I compared DIS to four other companies (Viacom CBS, Sony, Comcast and Vivendi) to create this ‘beta’.

After poring through financial reports and making some educated guesses, we arrived at a discount rate of 4.02%. This was used to discount the present cash flows above and get a terminal value for Walt Disney – i.e. how much the company would be worth many years in the future.

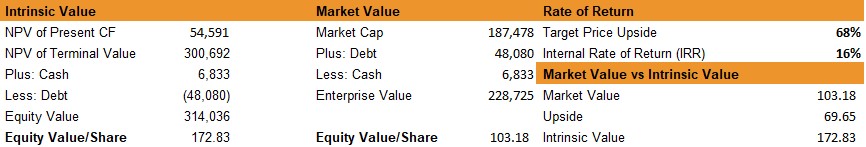

Eventually, I came up with an intrinsic value of Walt Disney Co of $314 billion and thus, a share price of $172.83, representing a target upside of 68% from its current price. However, as you can see, a bulk of that intrinsic value comes from the terminal value and not the five-year cash flows. This means that an investment in the company will only reap significant profits if held for a long time. Nevertheless, using Internal Rate of Return, an annual measure of profitability, still reaped a healthy 16% based on our DCF model.

Some of the assumptions I made…

Considering most of you would be students learning about investing, and as I am admittedly a ‘newbie’ at these technical models, I thought it would only be fair to discuss some of the assumptions and possible mistakes I made that had drastic impact on my calculations.

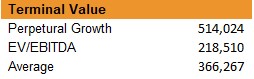

There are two methods to calculating terminal value: calculating perpetual growth and using an industry EV/EBITDA multiple. Our perpetual growth terminal value seems extraordinarily high and that is because I made a very conservative estimate of the average market rate of return when creating our discount rate. I used a 20-year average of the S&P500, which would have been impacted by the 2008 financial crises and current pandemic. However, I believe that the EV/EBITDA number is too low as well. While it is suggested that I use the media and entertainment industry median multiple of 7.8x, Walt Disney Co. has consistently had a higher EV/EBITDA multiple the past 10 years. Thus, I thought it was fair to take an average.

My conclusion after a dreadfully long article

My fingers ache from typing and my mind hurts from staring at numbers.

In conclusion, DIS is a great buy at this price, but hold it for the long-term. Its earnings report for Q2 FY20 will be out anytime soon, and with the current pandemic, I would hardly be surprised if the stock falls further. Don’t let that dampen your enthusiasm though, because I think this story is due for a happy ending.